How to Apply for GST Registration Online for Any Business 2026

Starting a business in India involves many compliance steps, and Goods and Services Tax registration is often one of the most confusing ones for business owners. Over the years, at ItsYourDigital, we’ve helped startups, freelancers, and growing businesses understand and complete their GST registration smoothly — without unnecessary delays or mistakes.

While it is possible to apply on your own, for accurate, error-free, and hassle-free results, it is always recommended to consult or hire a professional Chartered Accountant (CA). A CA ensures correct documentation, proper classification, and avoids future notices or penalties.

Based on real client queries and practical experience, this guide explains what GST enrolment is, why it matters, and who needs it. We’ve kept everything simple, clear, and easy to follow, so you can focus on building your business while staying compliant.

Let’s begin by understanding the basics.

What is GST Number?

GST registration is the process of registering a business under India’s Goods and Services Tax (GST) system.

Once registered, the business is issued a GST Identification Number (GSTIN), which allows it to:

- Legally collect GST from customers

- Claim input tax credit on business purchases

- Sell goods or services across different states

- Operate on e-commerce platforms

GST number ensures your business follows tax laws and runs smoothly.

Who Needs to Register for GST?

GST number is mandatory for certain types of businesses in India, based on their turnover, nature of work, and mode of operation. Below are the categories of businesses that must register under GST.

Businesses Crossing Turnover Limits

Any business whose annual turnover exceeds the prescribed GST threshold must register. For most states, the limit is:

- ₹40 lakh for goods-based businesses

- ₹20 lakh for service-based businesses

Once this limit is crossed, GST number becomes compulsory.

E-commerce Sellers

If you sell products through online platforms such as Amazon, Flipkart, Meesho, or similar marketplaces, GST registration is mandatory regardless of your turnover.

Most e-commerce platforms also require sellers to provide a valid GST number to operate.

Service Providers

Businesses providing services such as digital marketing, IT services, consulting, design, or development must register for GST once their turnover crosses the service threshold.

Service providers offering interstate services are required to register even if their turnover is below the limit.

Freelancers and Consultants

Freelancers and independent professionals like content writers, designers, developers, and consultants need tax registration if:

- Their income crosses the service threshold, or

- They provide services to clients in other states or countries

It also improves credibility when working with corporate clients.

Inter-State Businesses

Any business involved in supplying goods or services across state borders must register for GST, irrespective of turnover limits.

This applies to both physical businesses and online service providers.

Voluntary GST Registration

Businesses that do not meet mandatory requirements can still opt for voluntary registration under GST.

Voluntary registration helps with:

- Claiming input tax credit

- Improving business credibility

- Expanding to online and inter-state markets

However, once registered voluntarily, GST compliance becomes mandatory.

Documents Required for registration under GST

To apply for GST Number, businesses must submit a set of basic documents. The exact requirements may vary slightly depending on the type of business, but the documents listed below are commonly required in most cases.

Common Documents for All Businesses

These documents are mandatory for almost every application:

- PAN Card

PAN of the business owner or entity is compulsory for registration under GST.

- PAN Card

- Aadhaar Card

Aadhaar of the proprietor, partner, or director is required for identity verification.

- Aadhaar Card

- Address Proof of Business Place

This can include electricity bill, water bill, property tax receipt, or rent agreement.

- Address Proof of Business Place

- Bank Account Details

Cancelled cheque or bank statement showing account number, IFSC, and account holder name.

- Bank Account Details

- Photograph

Passport-size photograph of the applicant (proprietor/partners/directors).

- Photograph

- Email ID & Mobile Number

A valid email and mobile number are required for OTP verification and GST communication.

- Email ID & Mobile Number

Business-Type Specific Documents

Sole Proprietorship

- PAN and Aadhaar of proprietor

- Address proof of business location

- Bank account details in proprietor’s name

Partnership Firm

- PAN of the firm

- Partnership deed

- Aadhaar and PAN of all partners

- Address proof of the business place

Private Limited Company / LLP

- PAN of company/LLP

- Certificate of incorporation

- Memorandum & Articles of Association (MOA/AOA)

- PAN and Aadhaar of directors/partners

- Address proof of registered office

Rented Business Premises

- Rent agreement

- NOC from property owner (if required)

- Latest utility bill (electricity/water)

Need Help with GST enrolment?

GST documentation can feel confusing, especially for first-time business owners. Even a small mistake can delay approval or lead to rejection.

If you’d like personal guidance or help understanding which documents apply to your business, you can connect with our team at Itsyourdigital. We’ll guide you through the process and help you coordinate with the right professionals for smooth GST enrolment.

Applying for a GST number is an online process through the official GST portal. While the steps may look simple, even small mistakes in details or document selection can lead to rejection or future compliance issues. That’s why professional guidance is highly recommended, especially for certain business categories.

Below is a simplified overview of the registration under GST process:

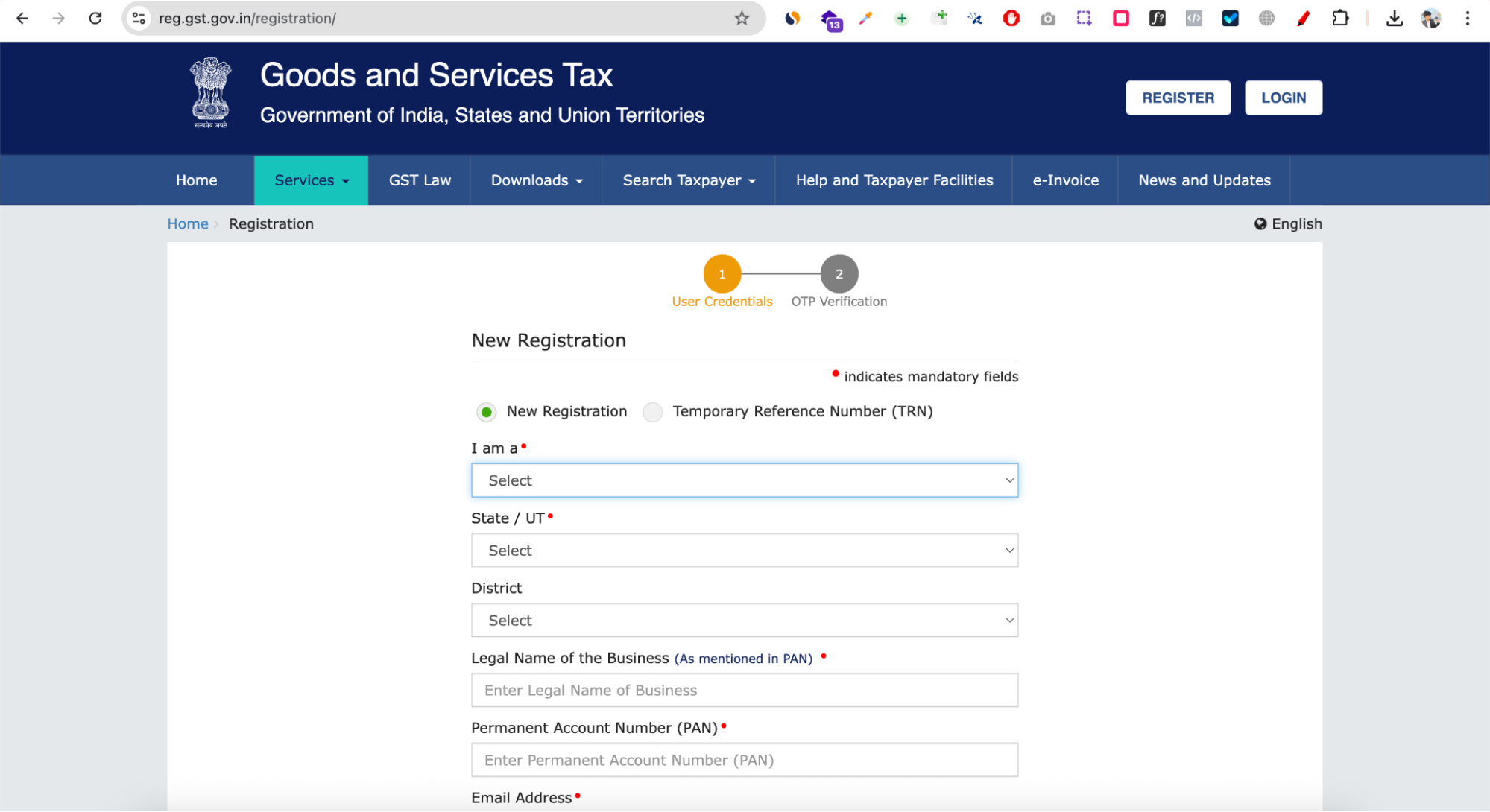

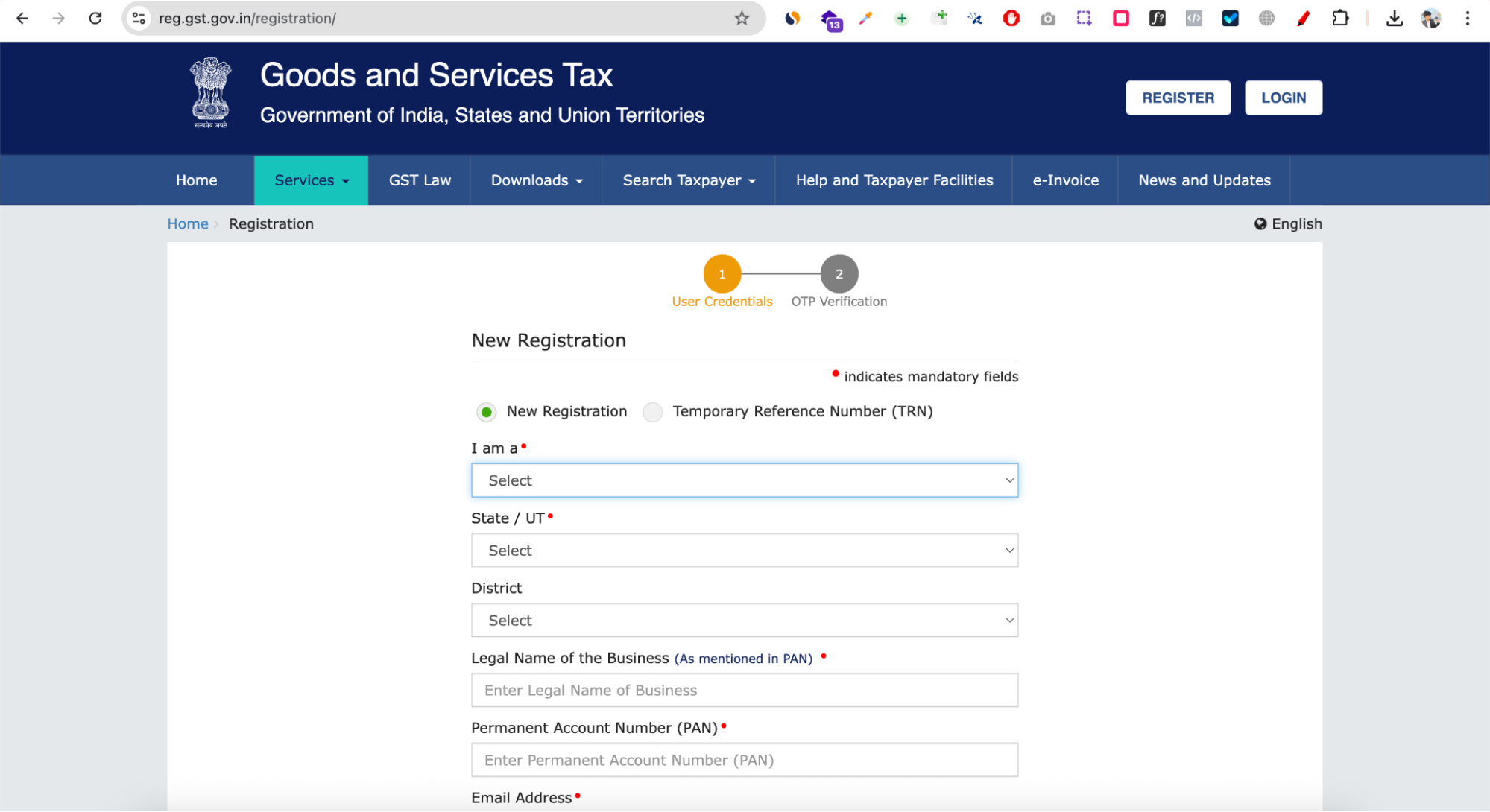

Step 1: Visit the GST Portal

Go to the official GST website and click on New Registration under the Services section.

Step 2: Create a New Registration

Enter basic details such as:

- Legal name of the business

- PAN number

- Email ID and mobile number

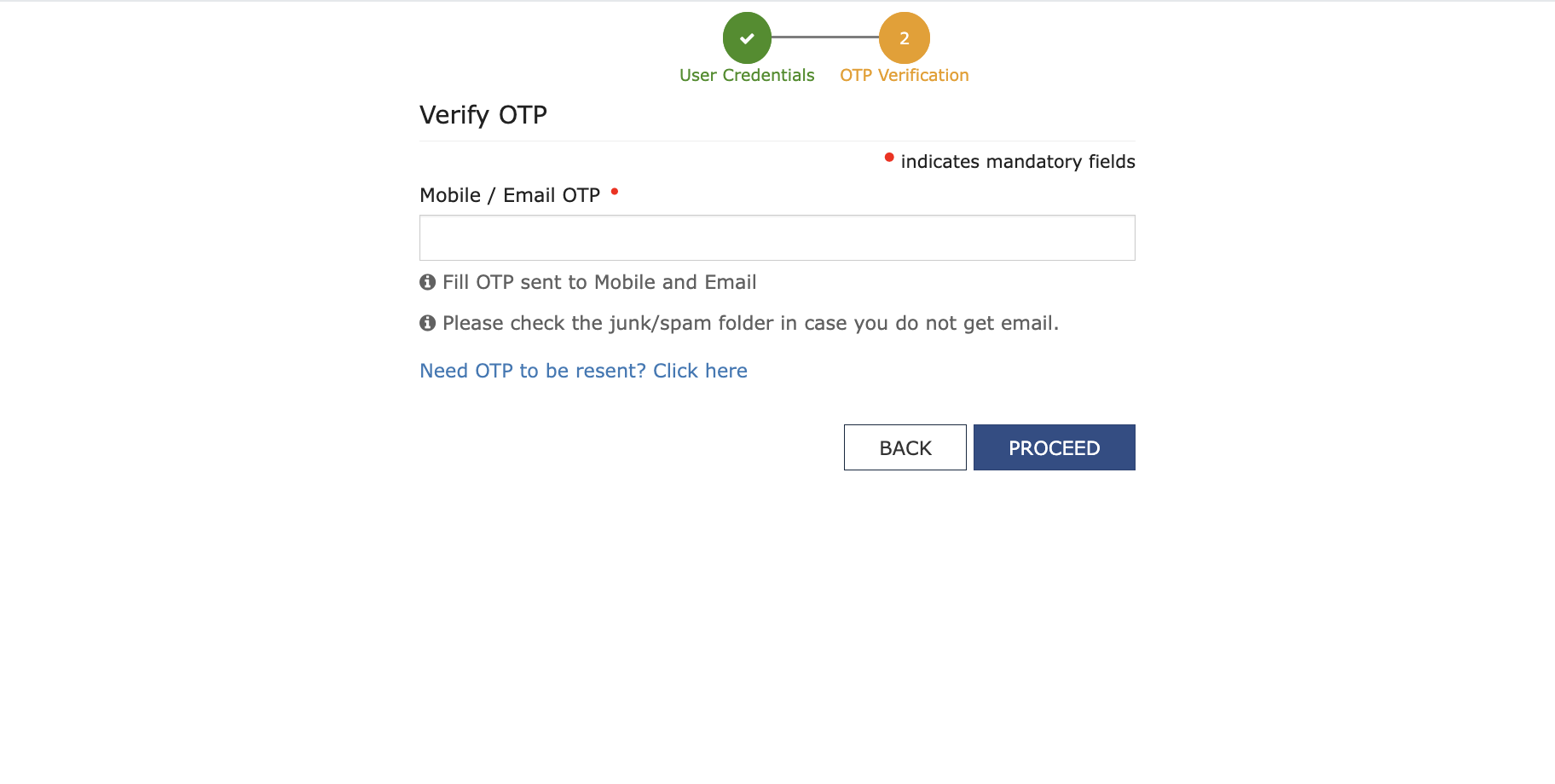

You will receive OTPs for verification.

Step 3: Fill Business Details

Carefully enter business information, including:

- Business type and category

- Principal place of business

- Nature of goods or services

- Bank account details

This step is crucial, as incorrect classification can cause future GST issues.

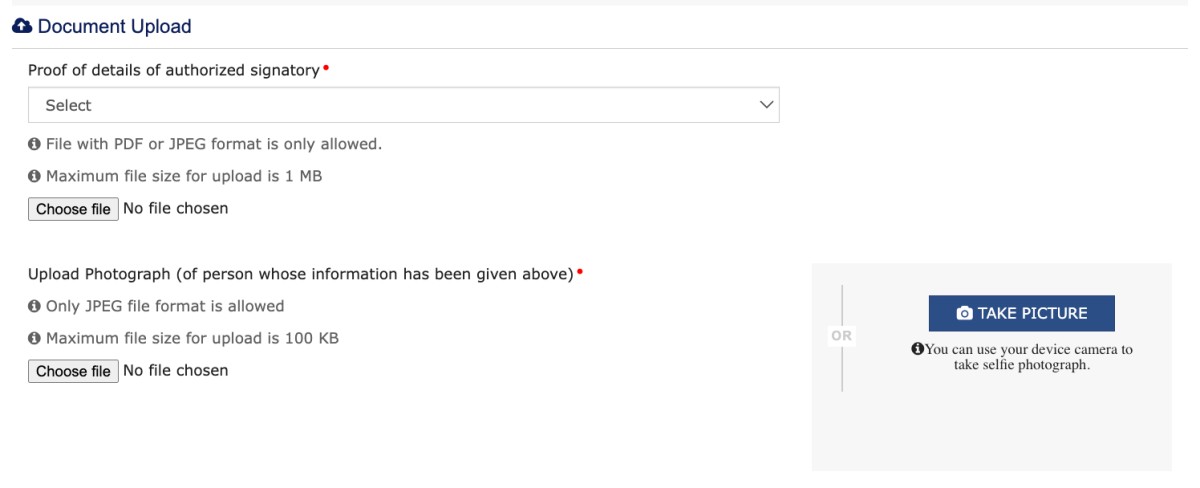

Step 4: Upload Required Documents

Upload clear and valid copies of:

- PAN and Aadhaar

- Address proof

- Bank details {Cancelled check}

- Business proof documents

Make sure all documents match the information entered in the form.

Step 5: Aadhaar Authentication

Complete Aadhaar authentication to speed up the registration process. This helps in faster approval and reduces verification delays.

Step 6: Submit the Application

After reviewing all details carefully, submit the application on the GST portal.

Step 7: ARN Generation

Once submitted, an Application Reference Number (ARN) is generated. You can use this number to track your GST application status online.

Important Note: Be Careful While Applying

GST enrolment may seem straightforward, but it involves multiple technical selections — especially for:

- Service providers

- E-commerce sellers

- Inter-state businesses

- Firms with multiple partners or directors

Incorrect choices can lead to notices, penalties, or cancellation later. For many business categories, professional CA guidance is strongly recommended to ensure proper registration.

If you want a smooth, error-free GST number, you can connect with our support team at Itsyourdigital. We help businesses understand the process, prepare documentation correctly, and coordinate with professionals to complete GST enrolment without stress.

GST compliance for Different Business Types

GST compliance requirements vary slightly depending on the type of business. Understanding your business structure helps ensure you choose the correct category while applying and avoid future compliance issues.

Sole Proprietorship

A sole proprietorship is owned and managed by a single individual.

- Turnover crosses the prescribed GST threshold, or

- The business provides inter-state services or sells online

Documents usually required:

- PAN and Aadhaar of the proprietor

- Address proof of business

- Bank account details

This is the most common structure for small businesses and startups.

Partnership Firm

A partnership firm is owned by two or more partners operating under a partnership deed.

GST compliance is mandatory if:

- Turnover crosses the threshold, or

- The firm is involved in inter-state supply or e-commerce

Additional documents required:

- PAN of the firm

- Partnership deed

- PAN and Aadhaar of all partners

Private Limited Company

A private limited company is a separate legal entity registered under the Companies Act.

GST compliance is mandatory in most cases, especially if:

- The company provides taxable goods or services

- It operates across states or online platforms

Key documents include:

- Certificate of incorporation

- PAN of the company

- MOA and AOA

- PAN and Aadhaar of directors

Professional CA assistance is strongly recommended for companies due to compliance complexity.

Limited Liability Partnership (LLP)

An LLP combines features of a partnership and a company.

GST compliance is required if:

- Turnover crosses GST limits, or

- The LLP supplies goods or services inter-state

Documents needed:

- PAN of LLP

- LLP agreement

- PAN and Aadhaar of partners

- Registered office address proof

LLPs must be careful while selecting business categories and services during registration.

Freelancers & Home-Based Businesses

Freelancers, consultants, and home-based businesses often assume GST is not required, but this is not always true.

tax registration is required if:

- Income crosses the service threshold

- Services are provided to clients in other states or countries

Examples include:

- Digital marketers

- Designers and developers

- Consultants and coaches

tax registration also improves credibility when working with corporate clients.

Important Note

Choosing the wrong business type during GST number can lead to notices or cancellation later. For accurate classification and smooth registration, professional CA guidance is highly recommended.

If you need personal guidance or help understanding which category applies to your business, you can connect with our team at ItsYourDigital for support

Can You Get GST Without a Commercial Office?

Yes, you can apply for tax registration even if you do not have a commercial office. Many small businesses, freelancers, and online sellers successfully register for GST using a residential address.

Let’s understand how this works.

GST Registration on a Residential Address

GST law allows businesses to register using a residential address as their principal place of business.

This is applicable when:

- The business is operated from home

- There is no separate office or shop

- Services or goods are managed remotely

As long as valid address proof is provided, GST registration on a residential address is permitted.

GST for Home-Based Businesses

Home-based businesses are very common today, especially in the service sector.

Examples include:

- Digital marketing agencies

- Designers and developers

- Consultants and freelancers

- Online tutors and coaches

Such businesses can easily register for GST using:

- Electricity or water bill of residence

- Ownership proof or rent agreement (if rented)

Proper documentation and correct declaration are important to avoid queries.

Online Sellers and Service Providers

Online sellers and service providers must register for GST, even without a physical office.

This includes:

- Sellers on Amazon, Flipkart, Meesho, etc.

- Freelancers providing services to clients in other states or countries

- Service providers working remotely

Most online platforms require a valid GST number, regardless of business location.

Conclusion

Getting a GST number is an important step for any business operating in India. From understanding whether GST applies to your business, preparing the right documents, choosing the correct business category, to submitting the application carefully each step plays a crucial role in smooth approval and future compliance.

Registering early helps you avoid penalties, build credibility with clients, and operate confidently across states and online platforms. Delaying GST registration or applying incorrectly can lead to unnecessary notices, rejections, or compliance issues later.

While the GST registration process is online, professional guidance from a qualified CA is highly recommended to ensure error-free registration, especially for service providers, e-commerce sellers, freelancers, and growing businesses.

If you’re looking for personal guidance, you can connect with our team at ItsYourDigital. We help businesses not only with GST-related assistance but also support their complete growth journey — from website development and SEO-friendly content, to digital marketing, branding,AI videos, influencer marketing, and in-house printing solutions.

Whether you’re starting a new business or scaling an existing one, we’re here to help you build, grow, and market your brand smoothly — the right way.